AI/ML model

AI model for analyzing historical stock prices

import requests

import tqdm

from FiinQuantX import FiinSession

from bs4 import BeautifulSoup

import google.generativeai as genai

import re

import numpy as np

import pandas as pd

import os

GOOGLE_GEMINI_API_KEY = os.getenv('GOOGLE_GEMINI_API_KEY')

genai.configure(api_key=GOOGLE_GEMINI_API_KEY)

model = genai.GenerativeModel("gemini-1.5-flash")

client = FiinSession('USERNAME', 'PASSWORD').login()

VCB_data = client.Fetch_Trading_Data(

tickers=['VCB'],

fields=['close'],

realtime=False,

adjusted=True,

by='1d',

from_date='2020-01-01',

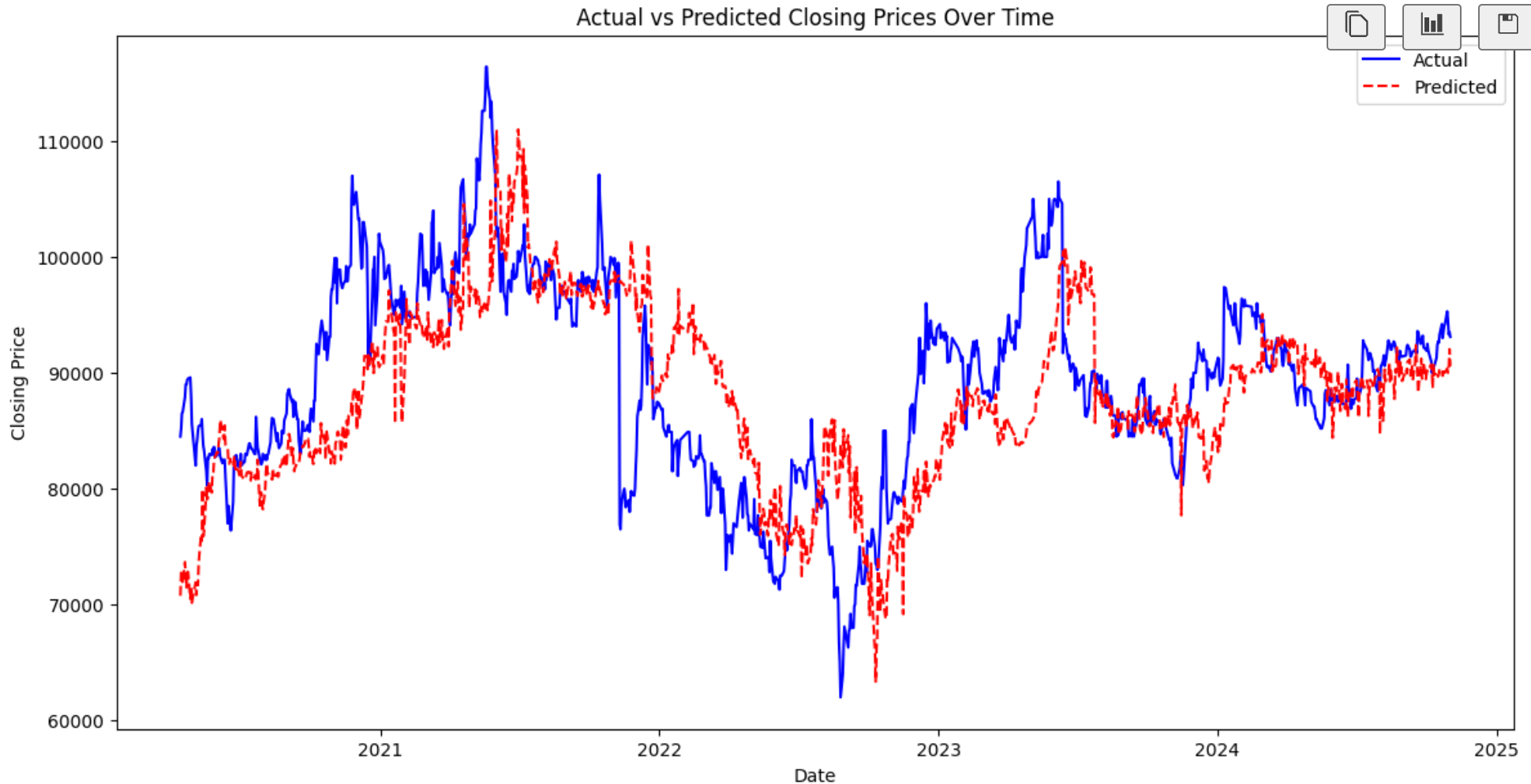

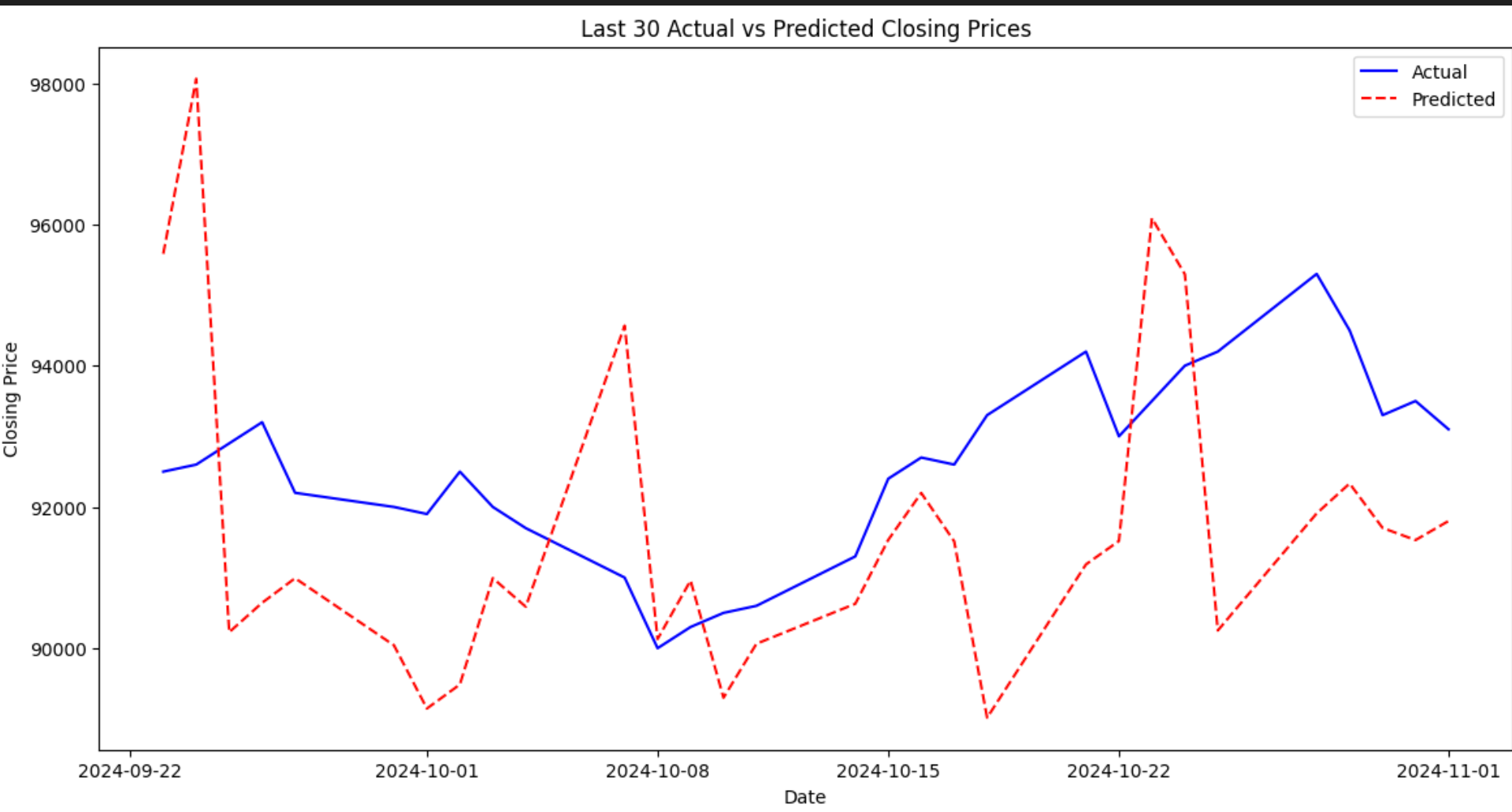

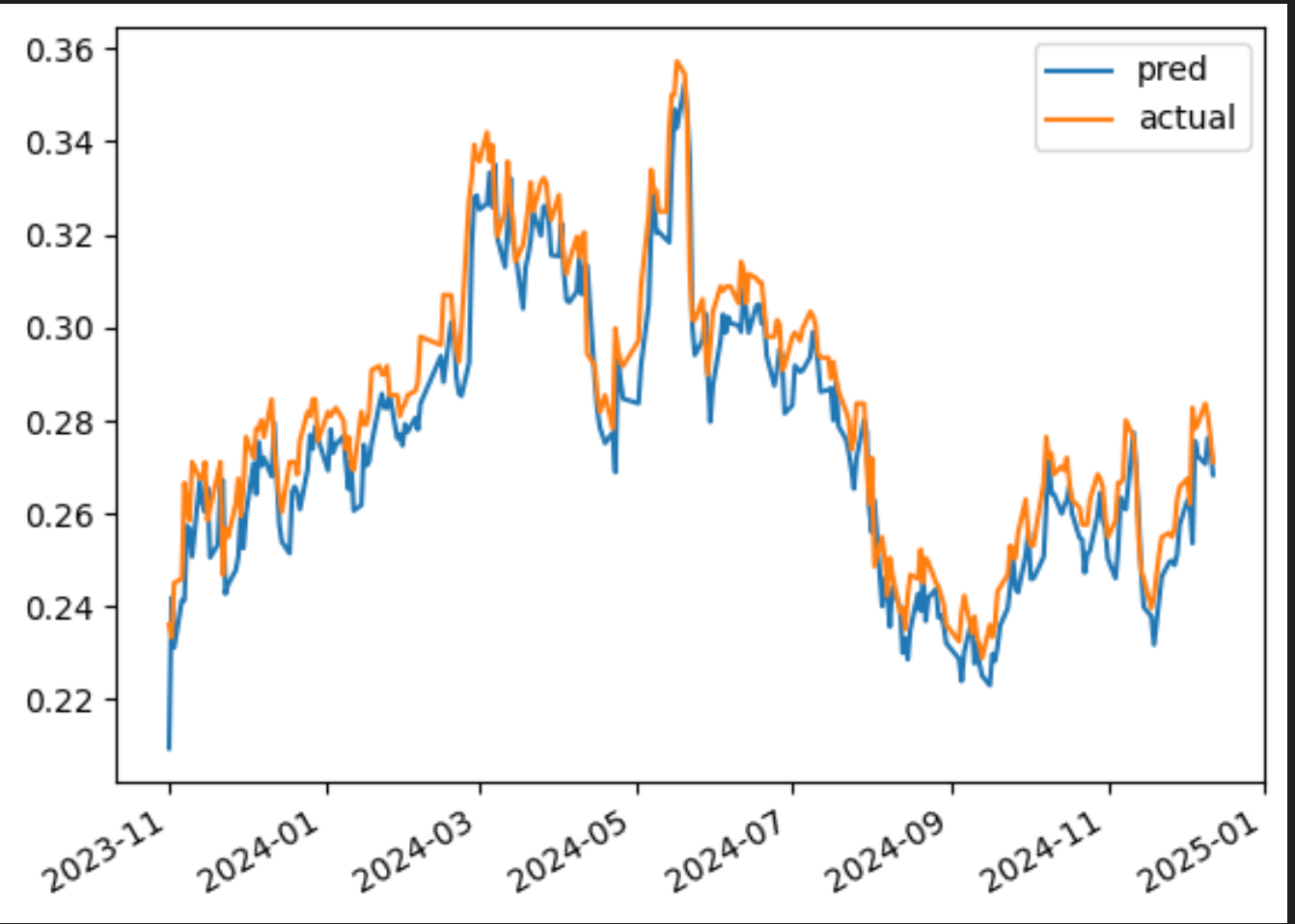

to_date='2025-01-29').get_data()Machine learning model for stock price prediction

1. Linear Regression

2. Random Forest/ XG Boost

3. Long short-term memory network (LSTM)

Last updated